What is ending inventory?

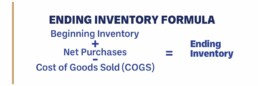

Determining the amount of stock left at the end of a sales cycle is important. Ending inventory, sometimes called closing inventory, is the total value of unsold goods at the end of an accounting period. This valuation provides insight into assets, gross profit, pricing, ordering, and production. The simplest formula for calculating ending inventory is to add net purchases to your beginning inventory and subtract the cost of goods sold.

Why calculating ending inventory is necessary.

Calculating ending inventory is vital to know how much you are selling and for how much. It is also a key aspect of the accounting process because it directly affects your balance sheet and tax burden. Here are some reasons why getting your ending inventory valuations right is essential:

- Verifies recorded inventory matches, actual physical inventory counts

- Highlights inventory shrinkage issues due to human error, theft, or other reasons.

- Reveals how much revenue you are making on what you are selling.

- Minimizes overstock by providing accurate inventory counts.

- Delivers excellent insight and control over stock-related and financial decisions

- Impacts gross and net profits as well as tax liabilities.

- Allows investors and financial institutions to evaluate for funding events

- Selecting the best method and staying consistent with that method will provide insight into the health and profitability of the company.

Selecting the best method to calculate your ending inventory and staying with that method is imperative to minimize accounting errors and meet company needs. The choice can affect the stated value of the company’s assets, profit, and tax liability. Before filing your income or end-of-year taxes, it is necessary to calculate your ending inventory correctly.

What are the different methods to calculate ending inventory?

Knowing your ending inventory gives you insight into how to make necessary business decisions related to stock, finances, and even fulfillment needs. Here are a few standard methods to calculate ending inventory.

FIFO method (first in, first out)

FIFO is a valuation method that assumes the first purchased inventory was sold first. The COGS (cost of goods sold during the period) is based on the stock bought earliest in the accounting period. This approach is suitable for many companies because it follows common operations strategies where older items are sold to make room for newer goods. This method is commonly used during an inflationary period. However, it can produce lower COGS and higher gross profits. This calculation often results in higher income tax burdens for the period.

LIFO method (last in, first out)

LIFO is another valuation method that assumes the most recently purchased goods are the first to be sold. This method closely reflects the actual cost of replacing the current inventory. It is typically used during periods of increasing prices. Companies can report higher COGS and lower gross profits, reducing the tax liability during the period. A significant drawback of this method is that it is rarely accepted outside of the US because it is not allowed under International Financial Reporting Standards (IFRS).

WAC method (weighted average cost)

The weighted average cost method (WAC) is where a business average all inventory costs to calculate COGS and ending inventory. Calculate it by dividing the total amount you spent on your inventory by the total number of items.

Here is a simple example. Let’s say you started your fiscal year with an inventory balance of 1000 items at $3.00 each. You purchased an additional 500 items at $3.50 later in the accounting period. Your ending inventory would include 1500 items valued at $3.17 each, totaling $4,750.

This method is the simplest way to evaluate ending inventory; it is best suited for companies that sell similar products. As businesses expand their product offering, calculating ending inventory becomes more complex.

Gross profit method

The gross profit method estimates ending inventory where an actual physical count is not desired or necessary. This method uses the company’s expected gross profit margin for the current period as a starting point for estimating COGS and ending inventory. Companies will use their historical gross profit margin as a guideline for their current expected gross margin. Keep in mind that this method is not acceptable for audited financial statements.

Here are the steps to calculate gross profit:

- Multiply the net sales during the current period by (1 – expected gross profit margin) to obtain an estimate of COGS.

- Apply the standard inventory valuation formula: Add up the period’s beginning inventory and the cost of all further inventory purchases to date. Then, subtract the estimated COGS to obtain the ending inventory.

Retail method

This method is best for retail stores looking to estimate inventory counts for a specific timeframe without doing a physical count. It uses the cost-to-retail ratio.

Total Cost Of Goods For Sale / Retail Value Of Those Goods = Cost-To-Retail Ratio

Once you have the cost-to-retail ratio, you multiply this number by the net sales for the period to estimate COGS. Then you plug this amount into the standing ending inventory formula listed above. This is an imprecise count but is helpful to assess ending inventory until a more accurate method can be performed for accounting and tax purposes.

How partnering with a 3PL can help with inventory management.

A 3PL provider can help with inventory management in several ways. First, they can provide warehousing and fulfillment services, which involve storing inventory, packaging, and shipping orders. They can perform physical stock counts when needed. They can also help track inventory, which is essential for keeping accurate records and preventing out-of-stock or overstocked situations.

In addition, a 3PL can help with inventory forecasting, which involves predicting future demand for products. Overall, a 3PL can be an excellent asset for any business that needs help with inventory management. By outsourcing complex inventory tracking and management task, companies can save time and money while improving customer service and satisfaction.

Beginner’s Guide to Third-Party Logistics (3PL)

The world of e-commerce is always changing, therefore understanding the roll of Third-Party Logistics is integral to keeping up. In light of this our beginner’s guide to third-party logistics (3PL) will delve into the essential aspects, offering insights into fulfillment services, warehousing, and much more.

Read More…

Because inventory directly affects your business’s balance sheet and income, it is necessary to choose a method that aligns with business needs and operations workflows. Whether you manage inventory in-house or outsource it to a 3PL partner, calculating accurate ending inventory is an essential metric for your business.